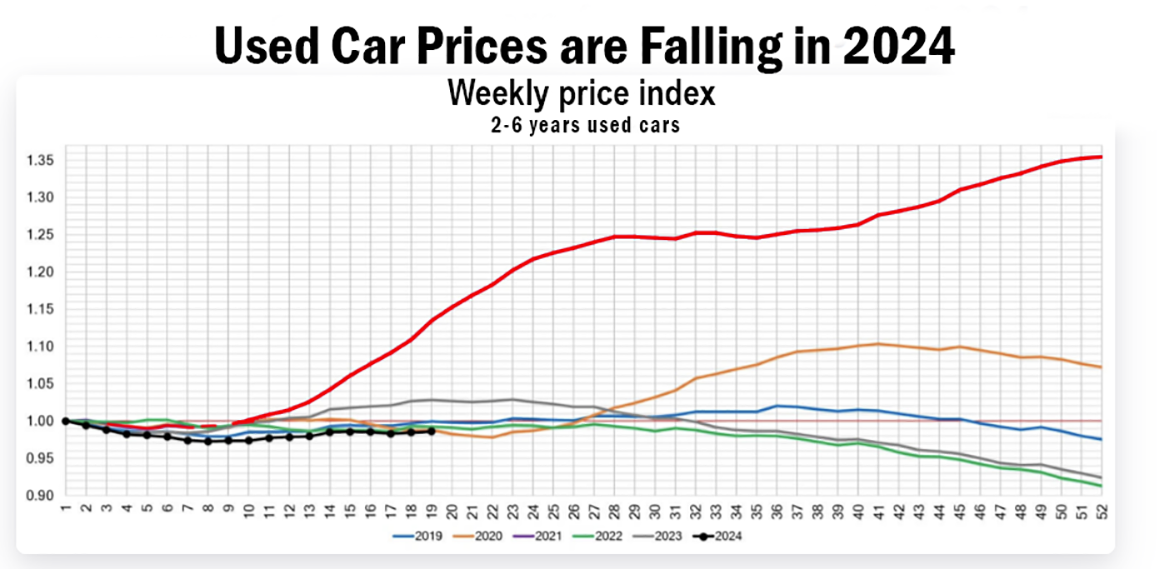

Why Used Car Prices Are Falling

For the past several years, the used car market has been a tale of unprecedented highs. A perfect storm of economic and logistical factors created a seller’s paradise where pre-owned vehicles were often selling for more than their original sticker price. However, the winds have shifted. A noticeable and significant correction is underway, bringing used car prices back down to earth. For millions of consumers, understanding the dynamics behind this market cooldown is crucial, whether you’re looking to buy, sell, or simply understand the broader economic indicators at play. This in-depth analysis will explore the multifaceted reasons for the price decline, project where the market is headed, and provide strategic advice for navigating this new landscape to your advantage.

A. The Perfect Storm That Inflated the Used Car Market

To understand the current decline, we must first appreciate the extraordinary factors that drove prices to record levels. The period from 2020 to 2022 was an anomaly in automotive history.

A. The Global Microchip Shortage: The COVID-19 pandemic triggered a massive disruption in the global supply of semiconductor chips, a critical component in modern vehicles. New car production lines slowed to a crawl or halted entirely. With fewer new vehicles on dealer lots, consumer demand was funneled directly into the used car market, creating intense competition for a limited supply.

B. Unprecedented Pent-Up Demand and Stimulus Funds: As lockdowns eased, a combination of pent-up demand and government stimulus payments infused consumers with both the desire and the financial means to buy vehicles. Many people sought private transportation to avoid public transit, further heating up the market.

C. The Rental Car Fleet Depletion: During the peak of the pandemic, rental car companies, major suppliers of late-model used cars, sold off significant portions of their fleets to stay afloat. This removed a critical source of inventory for the used market, exacerbating the supply shortage.

D. Soaring Consumer and Dealer Financing: With interest rates at historic lows, financing was cheap and readily available. This allowed both individual buyers and dealers to bid aggressively on available inventory, pushing prices ever higher.

B. The Pendulum Swings: Key Factors Driving the Current Price Correction

The market’s peak was unsustainable. A combination of economic pressures and market normalization is now applying downward pressure on used car values.

A. The Aggressive Rise in Interest Rates

The most powerful force currently reshaping the market is the Federal Reserve’s campaign to combat inflation by raising interest rates.

-

Impact on Consumer Loans: As loan rates climb from 3-4% to 7-9% or higher, the monthly payment for the same vehicle increases dramatically. This prices a significant segment of potential buyers out of the market, reducing overall demand.

-

Impact on Dealerships: Dealers rely heavily on lines of credit to purchase used vehicle inventory. Higher borrowing costs mean they can no longer afford to pay top dollar for used cars at auction, as their potential profit margin is squeezed by their own financing expenses. This forces them to lower their bids, which directly lowers wholesale prices.

B. The Rebound in New Vehicle Inventory and Incentives

The microchip shortage has significantly eased, allowing new car production to ramp back up.

-

Increased Availability: Consumers who were forced to buy used during the shortage now have a viable alternative. The return of new cars to dealer lots provides direct competition for used vehicles.

-

The Return of Incentives: To compete and clear inventory, manufacturers are slowly reintroducing customer cash offers, low-interest financing deals, and lease specials. These incentives make new cars more attractive and put downward pressure on the nearly-new used cars that were previously a “cheaper” alternative.

C. Shifting Economic Sentiment and Recession Fears

Growing concerns about a potential economic slowdown or recession are altering consumer behavior.

-

Decreased Disposable Income: With inflation affecting the cost of food, housing, and energy, many households are cutting back on large, discretionary purchases. A used car is often one of the first expenses to be postponed.

-

Cautious Spending: Economic uncertainty makes consumers more hesitant to take on a large debt obligation like a car loan. This “wait-and-see” approach further dampens demand.

D. A Market Flooded with Off-Lease Vehicles

The leasing cycle that was disrupted during the pandemic is now normalizing. Many consumers who leased vehicles in 2019 and 2020 are now returning their cars to dealerships. This influx of high-quality, well-maintained, 2-to-4-year-old off-lease vehicles is providing a much-needed injection of supply into the wholesale market, satisfying demand and creating more competitive pricing.

E. The Normalization of Wholesale Auctions

During the peak, the wholesale auction environment was frenzied, with dealers paying astronomical prices. That environment has calmed considerably. Auction conversion rates (the percentage of cars that actually sell) are declining, and sale prices are falling. This wholesale price drop is the leading indicator that filters down to retail prices on dealer lots within 60-90 days.

C. A Detailed Analysis of Vehicle Segments Most Affected

The price correction is not affecting all vehicles equally. Some segments are experiencing a much steeper decline than others.

A. Nearly-New Used Cars (1-3 Years Old)

This segment is the most vulnerable. As new car inventory improves and incentives return, the price gap between a new car and a one-year-old used model with 20,000 miles has narrowed significantly. For many buyers, it no longer makes financial sense to buy the used version, causing demand and prices for these vehicles to plummet.

B. Luxury Vehicles and High-End Trucks/SUVs

Premium brands like BMW, Mercedes-Benz, Audi, and Land Rover are seeing significant price drops. These vehicles are more sensitive to rising interest rates due to their higher loan amounts. Furthermore, their target demographic may be more affected by stock market volatility, and the high cost of ownership becomes less palatable in an uncertain economy.

C. Large Trucks and Full-Size SUVs

While still in high demand, the prices for used full-size pickups and SUVs are softening. Their high fuel consumption becomes a major liability when gas prices are volatile, and their high initial cost is magnified by rising loan rates.

D. Segment Showing Relative Stability: Affordable, Fuel-Efficient Cars

Economical compact cars and hybrids like the Toyota Corolla, Honda Civic, and Toyota Prius are holding their value better than most. Their appeal lies in their reliability, low maintenance costs, and excellent fuel efficiency, which are always in demand, especially during periods of economic pressure.

D. Strategic Advice for Buyers and Sellers in the New Market

Navigating this shifting market requires a new playbook. Whether you’re buying or selling, timing and strategy are everything.

A. The Buyer’s Playbook: How to Secure a Great Deal

For the first time in years, power is shifting back to the used car buyer.

A. Patience is Your Greatest Asset: The market is still correcting. The longer you can wait, the more prices are likely to fall. If you must buy now, be prepared to negotiate aggressively.

B. Focus on Vehicles with High Supply: Target vehicle segments that are experiencing the biggest price drops, such as luxury sedans or nearly-new models. There will be more inventory and more motivated sellers.

C. Get Pre-Approved for a Loan: Do not rely solely on dealer financing. Secure a pre-approval from your bank or credit union to know your best available rate and to use as a bargaining chip.

D. Scrutinize the Vehicle’s History: With more off-lease and former rental cars hitting the market, a vehicle history report (like Carfax or AutoCheck) is non-negotiable to avoid flood-damaged or poorly maintained vehicles.

E. Negotiate from the “Out-the-Door” Price: Focus your negotiation on the total cost of the vehicle, including all fees and taxes. This prevents dealers from hiding markups in confusing add-ons.

B. The Seller’s Playbook: How to Maximize Your Return

If you need to sell your used car, the strategy has changed dramatically from a year ago.

A. Adjust Your Price Expectations: Research your vehicle’s current market value using Kelley Blue Book (KBB) and Edmunds. Be realistic; the price you could have commanded six months ago is likely no longer attainable.

B. Prepare and Present Your Vehicle: First impressions are critical. A thorough cleaning, both inside and out, and having all service records available can help your car stand out in a crowded market and justify a higher asking price.

C. Consider Private Party Sale: While more work, a private sale will typically yield a higher return than a trade-in. Use online platforms like Facebook Marketplace and Autotrader to reach a broad audience.

D. Act with Urgency: All indicators suggest prices will continue to soften. If you are planning to sell, doing it sooner rather than later will likely get you a better offer.

E. Future Outlook: Where Are Used Car Prices Headed?

Industry experts from firms like Cox Automotive (parent company of Kelley Blue Book and Manheim Auctions) project a continued, gradual decline in used vehicle prices throughout the year. The market is not headed for a crash, but rather a slow and steady normalization towards pre-pandemic pricing patterns, adjusted for inflation. The era of used cars as appreciating assets is over. The market is returning to its traditional role, where a vehicle is a depreciating purchase. Key factors to watch will be the Federal Reserve’s future interest rate decisions, the stability of new vehicle production, and the overall strength of the U.S. economy.

Conclusion: A Return to Rationality Benefits Everyone

The decline in used car prices, while challenging for sellers, is ultimately a healthy and necessary correction for the long-term stability of the automotive ecosystem. It marks a return to a more rational and balanced market where vehicles are valued for their utility and condition, not just their scarcity. For buyers, it represents a long-awaited opportunity to find value and affordability after years of inflated costs. By understanding the complex economic forces at play and adopting a strategic approach, consumers can now navigate the used car market with renewed confidence and financial savvy. The pendulum is swinging back, and it’s bringing a much-needed dose of reality with it.

Tags: used car prices, car market trends, buying a used car, selling a used car, used car value, auto market correction, interest rates car prices, used car buying guide, used SUV prices, car depreciation, Manheim Used Vehicle Index

Category: Automotive Industry